The 46+ Reasons for Iron Ore Price: While prices are not likely to remain above $200 per ton, there won't be a collapse and they could hover between $100 to $150 per ton, analysts at the singapore iron ore forum said.

Iron Ore Price | China, 62% fe beginning december 2008; Lastly choose the number of days to show in your chart. The industrial metal ore sold off overnight on reignited fears that chinese authorities may intervene in markets to cool rising prices. Grasp market research, analysis & market fundamentals data with refinitiv. Sinter fines and lumps make up the bulk of the seaborne iron ore market, and are the products most frequently traded on a spot basis, so daily pricing is used for the key 62% fe, 58% fe and 65% fe fines, and lump premium references.

The price saw dramatic drops in the past decade, from 139.87 u.s. Iron ore blast furnace pellet 64% fe 3% al cfr qingdao. Prices fell 7.7% to us$169.30/t according to commbank, while fastmarkets saw them down us12.14 to us$171.55/t this morning after a 5.6% drop in dalian futures on thursday. Iron ore (any origin) fines, spot price, c.f.r. Sinter fines and lumps make up the bulk of the seaborne iron ore market, and are the products most frequently traded on a spot basis, so daily pricing is used for the key 62% fe, 58% fe and 65% fe fines, and lump premium references.

Dollars, and increased to a high of 168 u.s. Lastly choose the number of days to show in your chart. Get all information on the price of iron ore including news, charts and realtime quotes. Dollars per dmtu in 2011. Iron ore price chart (usd / metric ton) for the last year. Data delayed at least 30 minutes, as of jul 01 2021 14:59 bst. China, 62% fe beginning december 2008; Sinter fines and lumps make up the bulk of the seaborne iron ore market, and are the products most frequently traded on a spot basis, so daily pricing is used for the key 62% fe, 58% fe and 65% fe fines, and lump premium references. The most traded iron ore futures on the dalian commodity exchange, for january delivery, closed down 7.2% to 763 yuan ($117.44) per tonne, after plunging to 8% earlier during the session. In 2019, global prices for iron ore averaged $112.15 per ton, an increase of 21% from $93 per ton in 2018. Iron ore (any origin) fines, spot price, c.f.r. 2 prices were $88 per ton as of march 2020. Simply select a metal and a unit to display the price.

In 2020, iron ore was worth an average of approximately 109 u.s. Iron ore (any origin) fines, spot price, c.f.r. Iron ore price chart (usd / metric ton) for the last year. Dce iron ore futures closed slightly higher than yesterday, although it hit the lowest 735 during trading period. Global economic growth is the primary factor that drives its supply and demand.

Iron ore spot price (any origin) is at a current level of 214.14, down from 214.43 last month and up from 108.52 one year ago. Dollars per dry metric ton unit (dmtu), compared to 30 u.s. Iron ore blast furnace pellet 64% fe 3% al cfr qingdao. Use this form to dynamically generate charts that show metal prices in the units of your choice and for the specified date range (if available). Iron ore prices slid to their lowest levels since april overnight, as speculation about chinese steel production cuts delivered a hit to the pilbara's big iron ore miners. Live iron ore price in usd: Global economic growth is the primary factor that drives its supply and demand. In 2020, iron ore was worth an average of approximately 109 u.s. Iron ore 62% fe, cfr china (tsi) swa. In 2019, global prices for iron ore averaged $112.15 per ton, an increase of 21% from $93 per ton in 2018. The highest marginal cost producer in iron ore is still below $100, exactly where it was before covid changed our world. The industrial metal ore sold off overnight on reignited fears that chinese authorities may intervene in markets to cool rising prices. Iron ore is one of the main ingredients used to produce steel.

In 2020, iron ore was worth an average of approximately 109 u.s. While prices are not likely to remain above $200 per ton, there won't be a collapse and they could hover between $100 to $150 per ton, analysts at the singapore iron ore forum said. In 2019, global prices for iron ore averaged $112.15 per ton, an increase of 21% from $93 per ton in 2018. When economies are growing, the need for steel in construction increases which drives the price up. The most traded iron ore futures on the dalian commodity exchange, for january delivery, closed down 7.2% to 763 yuan ($117.44) per tonne, after plunging to 8% earlier during the session.

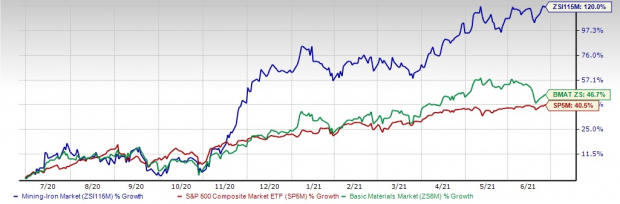

When economies are growing, the need for steel in construction increases which drives the price up. Sinter fines and lumps make up the bulk of the seaborne iron ore market, and are the products most frequently traded on a spot basis, so daily pricing is used for the key 62% fe, 58% fe and 65% fe fines, and lump premium references. 2 prices were $88 per ton as of march 2020. Iron ore (any origin) fines, spot price, c.f.r. Thomson reuters datastream, world bank. Iron ore blast furnace pellet 64% fe 3% al cfr qingdao. Dollars per dmtu in 2003. Dce iron ore futures closed slightly higher than yesterday, although it hit the lowest 735 during trading period. Get detailed information about iron ore fines 62% fe cfr futures including price, charts, technical analysis, historical data, reports and more. So massive was the surge of iron ore prices that in july they averaged a record high of us$214 ($291) per tonne. Historically, iron ore 62% fe reached an all time high of 219.77 in july of 2021. Prices fell 7.7% to us$169.30/t according to commbank, while fastmarkets saw them down us12.14 to us$171.55/t this morning after a 5.6% drop in dalian futures on thursday. Get all information on the price of iron ore including news, charts and realtime quotes.

Iron Ore Price: Prices fell 7.7% to us$169.30/t according to commbank, while fastmarkets saw them down us12.14 to us$171.55/t this morning after a 5.6% drop in dalian futures on thursday.

0 Response to "The 46+ Reasons for Iron Ore Price: While prices are not likely to remain above $200 per ton, there won't be a collapse and they could hover between $100 to $150 per ton, analysts at the singapore iron ore forum said."

Post a Comment